CBSE Class 12 – Economics Question Paper 2023

SECTION A

Macro Economics

1.Read the following statements carefully:

Statement 1: Primary deposits are the cash deposits by general public with commercial banks.

Statement 2: Secondary deposits are those deposits which arise on account of credit provided by the commercial banks to the people.

In light of the given statements, choose the correct alternative from the following:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 1 is false and Statement 2 is true.

(c) Both Statements 1 and 2 are true.

(d) Both Statements 1 and 2 are false.

Answer: (b) Statement 1 is false and Statement 2 is true.

Answer : (b)

Question 3: The rate at which commercial banks borrow from the Reserve Bank of India to meet their long-term requirements is known as ______________. (Choose the correct alternative to fill up the blank)

(a) Margin requirement

(b) Bank rate

(c) Repo rate

(d) Reverse repo rate

Answer: (b) Bank rate

Question 4: Read the following statements carefully:

Statement 1: Borrowings by a nation from the World Bank to finance Balance of Payment (BoP) deficit will be recorded in the capital account.

Statement 2: Autonomous transactions are independent of the condition of Balance of Payment (BoP) account.

In light of the given statements, choose the correct alternative from the following:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 1 is false and Statement 2 is true.

(c) Both Statements 1 and 2 are true.

(d) Both Statements 1 and 2 are false.

Answer: (c) Both Statements 1 and 2 are true.

Question 5: Read the following news report carefully:

“The central bank has imposed a fine on Hisar Urban Cooperative Bank Ltd. and Andaman and Nicobar State Cooperative Bank Ltd. for violation of banking norms.”

According to the given report, identify the function of the central bank.

(a) Issue of currency

(b) Banker to the public

(c) Banker to the Government

(d) Banker’s Bank

Answer: (d) Banker’s Bank

Question 6(A): If the value of the investment multiplier = 4 and Dissavings = (-) 60, identify the correct Saving function from the following:

(a) S = (-) 60 + 0·25 Y

(b) S = (-) 60 + 0·75 Y

(c) S = (-) 60 + 0·20 Y

(d) S = (-) 60 + 0·60 Y

Answer: (b) S = (-) 60 + 0·75 Y

Question 6(B): For the given Consumption function, C = 205 + 0·9 Y, the value of the investment multiplier would be ___________.

(a) 0·09

(b) 10·0

(c) 0·9

(d) 9·0

Answer: (d) 9·0

Question 7: Read the following statements: Assertion (A) and Reason (R). Choose the correct alternative given below:

Assertion (A): Before reaching the Break-Even level of income, the value of Average Propensity to Consume (APC) is greater than one.

Reason (R): The Average Propensity to Consume (APC) is the ratio of total consumption and total income.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true and Reason (R) is false.

(d) Assertion (A) is false and Reason (R) is true.

Answer: (d) Assertion (A) is false and Reason (R) is true.

Question 11(a):

Distinguish between ‘Value Addition’ and ‘Final Value of Output’.

Answer:

-

Value Addition: This refers to the increase in the value of goods or services as a result of the production process. It is calculated by subtracting the cost of intermediate goods from the total value of output. Essentially, value addition represents the contribution made by each producer to the final output.

-

Final Value of Output: The final value of output refers to the total market value of goods and services produced in an economy or by a firm. It is the total value at which the final goods or services are sold, and it is not reduced by the cost of intermediate goods because it already includes the value added by them.

Question 11(b):

Find the Value Added by Firm A, from the following information:

| Particulars | Amount (in crore) |

|---|---|

| (i) Purchase of factor inputs by Firm A | 5 |

| (ii) Purchase of non-factor inputs by Firm A | 2 |

| (iii) Sales by Firm A to other firms in the domestic economy | 10 |

| (iv) Import of raw materials by firm A from the rest of the world | 50 |

| (v) Excess of opening stock over closing stock | 3 |

Answer: The value added by Firm A is calculated by subtracting the cost of intermediate goods (purchases of non-factor inputs and imported raw materials) from the total revenue generated by sales. Here’s how it’s calculated:

-

Total Sales by Firm A (Revenue) = ₹10 crore

-

Intermediate Inputs:

- Purchase of non-factor inputs = ₹2 crore

- Import of raw materials = ₹50 crore

Total Intermediate Goods = ₹2 crore + ₹50 crore = ₹52 crore

-

Value Added = Total Sales – Intermediate Goods = ₹10 crore – ₹52 crore = ₹(42) crore

So, the value added by Firm A = ₹(42) crore.

Question 12:

“There exists a positive relation between foreign exchange rate and supply of foreign exchange.” Do you agree with the given statement? Justify your answer with valid arguments.

Answer:

Yes, there exists a positive relationship between the foreign exchange rate and the supply of foreign exchange, and here’s why:

- When the exchange rate (the price of one currency in terms of another) rises, the value of the domestic currency falls. As a result, exports from the country become cheaper and more attractive to foreign buyers.

- A lower exchange rate means foreign goods and services are more expensive, leading to reduced imports, and this stimulates the supply of foreign exchange as exporters earn more in foreign currency.

Therefore, an increase in exports due to a favorable exchange rate will lead to a higher supply of foreign exchange in the market.

Question 13:

Describe the adjustment mechanism, if ex-ante savings are less than ex-ante investments.

Answer:

If ex-ante savings (intended savings) are less than ex-ante investments (intended investments), the economy will experience a disequilibrium in the goods market. Here’s how the adjustment process works:

- Excess Demand for Goods and Services: Since investments are greater than savings, there is an excess demand in the economy. Firms will respond by increasing their output to meet this demand.

- Increase in Income and Output: As firms increase production, they need more labor, leading to higher wages and income. This results in an increase in overall income in the economy.

- Increase in Savings: As income increases, the savings of individuals will also increase (assuming a positive marginal propensity to save).

- Eventually, the rise in savings will match the level of investments, restoring equilibrium in the goods market.

This process ensures that ex-ante savings equal ex-ante investments, as the economy adjusts to the initial imbalance.

Question 14:

Read the following news published on September 26, 2022: “The central bank has increased the benchmark lending rate by 140 basis points.” Identify the likely cause and consequences behind this action taken by the Reserve Bank of India.

Answer:

Cause:

- The primary cause of the central bank’s decision to increase the benchmark lending rate is typically to control inflation. An increase in the lending rate makes borrowing more expensive, which can reduce consumer and business spending, thereby cooling down inflationary pressures in the economy.

Consequences:

- Increased Borrowing Costs: Higher lending rates make loans more expensive for consumers and businesses, leading to reduced borrowing and spending.

- Reduced Consumption and Investment: As credit becomes more costly, both consumption and investment in the economy may slow down, which can lead to a reduction in demand for goods and services.

- Control Over Inflation: The primary consequence is the reduction in inflation. With reduced demand in the economy, price pressures will ease.

- Currency Appreciation: Higher interest rates may attract foreign investment, increasing demand for the domestic currency, which can lead to its appreciation.

Question 15(a):

Explain the ‘Government’s Bank’ function of the central bank.

Answer:

The ‘Government’s Bank’ function refers to the role the central bank plays as the banker and financial agent for the government. Key activities include:

- Managing Government Accounts: The central bank holds and manages the accounts of the central government, conducting transactions such as receipts, payments, and transfers.

- Issuing Government Securities: The central bank helps the government in issuing bonds and securities in the market to raise funds.

- Advisory Role: The central bank advises the government on financial and monetary matters.

- Managing Foreign Exchange Reserves: The central bank manages the country’s foreign exchange reserves and assists in managing the exchange rate of the domestic currency.

- Debt Management: The central bank helps in managing the government’s debt, including buying and selling government securities.

Question 15(b):

Using a hypothetical numerical example, explain the effect of rise in Reserve Ratio on credit creation by the commercial banks.

Answer:

Let’s assume that the Reserve Ratio (the percentage of deposits that commercial banks are required to hold as reserves) is 10%. The credit multiplier is the inverse of the reserve ratio, i.e., 1 / reserve ratio.

-

When the reserve ratio is 10%, the credit multiplier is:

-

If a commercial bank receives a deposit of ₹1,000, the total potential credit creation by the banking system would be:

Effect of a rise in Reserve Ratio:

If the central bank raises the reserve ratio to 20%, the credit multiplier will decrease:

- New Credit Multiplier = 1 / 0.20 = 5

- With the same ₹1,000 deposit, the total potential credit creation now becomes:

Thus, an increase in the reserve ratio reduces the credit creation capacity of commercial banks, as they are required to hold a larger portion of their deposits in reserve and can lend out less.

Question 16(a):

“National Income is always greater than Domestic Income.” Do you agree with the given statement? Support your answer with a valid reason.

Answer:

No, I do not agree with the given statement that “National Income is always greater than Domestic Income.” The key difference between National Income (NI) and Domestic Income (DI) lies in the factor income received from abroad:

-

National Income includes the total income earned by the residents of a country, both domestically and abroad. This takes into account Net Factor Income from Abroad (NFIA), which is the difference between the income received by the country’s residents from foreign sources and the income paid to foreign residents within the country.

-

Domestic Income (or Gross Domestic Product, GDP) refers to the total income generated within the borders of a country, irrespective of who owns the factors of production (foreigners or domestic residents).

Thus, National Income could be greater or less than Domestic Income, depending on whether the country is a net receiver or net payer of income from abroad.

- If a country receives more income from its residents working abroad (NFIA > 0), National Income will be greater than Domestic Income.

- If a country is a net payer of income to foreign residents (NFIA < 0), National Income will be less than Domestic Income.

Therefore, the relationship depends on the net factor income from abroad.

Question 16(b):

“In the estimation of Gross Domestic Product (GDP) using the expenditure method, focus lies only on expenditure by the residents of the country.” Do you agree with the given statement? Give valid reasons for your answer.

Answer:

No, I do not fully agree with the statement. In the expenditure method of calculating Gross Domestic Product (GDP), the focus is on the total expenditure on final goods and services within a country, regardless of whether the spender is a resident or a non-resident.

The formula for GDP using the expenditure method is:

Where:

- C is the consumption expenditure (by households, residents, and non-residents)

- I is the investment expenditure (by businesses, both domestic and foreign)

- G is the government expenditure

- X is exports of goods and services

- M is imports of goods and services

Reasoning:

- The expenditure method includes the consumption and investment spending of both residents and non-residents in the country. For example, if a foreigner buys goods or services in the domestic economy, that expenditure is counted as part of GDP.

- The focus is not solely on residents, but rather on all final expenditures within the country’s borders, including those made by foreign entities or individuals.

Thus, the statement is not entirely accurate as GDP includes the expenditures made by both residents and non-residents within the country.

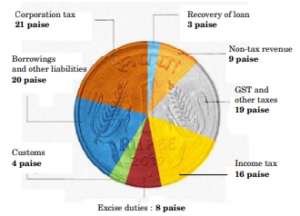

17. (a) (i) From the information given in the diagram, categorize the

items into revenue receipts and capital receipts, stating

valid reasons. 4

WHERE INDIA GETS ITS MONEY FROM?

(a) “National Income is always greater than Domestic Income.” Do you agree with the given statement? Support your answer with a valid reason.

Answer:

I disagree with the statement that “National Income is always greater than Domestic Income.”

Reason:

National Income can be greater than, equal to, or less than Domestic Income depending on the net factor income from abroad (NFIA).

-

National Income = Domestic Income + NFIA

-

If NFIA is positive (i.e., income earned by residents from abroad is greater than income earned by non-residents in the domestic territory), then National Income will be greater than Domestic Income.

-

If NFIA is negative (i.e., income earned by residents from abroad is less than income earned by non-residents in the domestic territory), then National Income will be less than Domestic Income.

-

If NFIA is zero (i.e., income earned by residents from abroad is equal to income earned by non-residents in the domestic territory), then National Income will be equal to Domestic Income.

Therefore, National Income is not always greater than Domestic Income. It depends on the value of NFIA.

(b) “In the estimation of Gross Domestic Product (GDP) using the expenditure method, the focus lies only on expenditure by the residents of the country.” Do you agree with the given statement? Give valid reasons for your answer.

Answer:

I disagree with the statement that “in the estimation of Gross Domestic Product (GDP) using the expenditure method, the focus lies only on expenditure by the residents of the country.”

Reasons:

While the expenditure method primarily considers final consumption expenditure and investment expenditure by residents, it also includes:

- Government Final Consumption Expenditure: This includes spending by government on goods and services, which benefits both residents and non-residents.

- Gross Fixed Capital Formation: This includes investments made by both residents and non-residents within the domestic territory.

- Net Exports (Exports – Imports): Exports are goods and services produced domestically and sold to both residents and non-residents. Imports are goods and services purchased from abroad by residents. The difference (net exports) impacts GDP.

Therefore, the expenditure method for GDP estimation considers expenditures made by both residents and non-residents on goods and services within the domestic territory.

(i) From the information given in the diagram, categorize the items into revenue receipts and capital receipts, stating valid reasons.

Answer:

Revenue Receipts:

- Corporation Tax (21 paise): Taxes are compulsory payments made to the government, and they are recurring in nature.

- Income Tax (16 paise): Similar to corporation tax, income tax is a direct tax and a regular source of government revenue.

- GST and Other Taxes (19 paise): GST (Goods and Services Tax) is an indirect tax levied on consumption and is a recurring source of revenue.

- Customs (4 paise): Customs duties are levied on imports and exports and are a regular source of government revenue.

- Excise Duties (8 paise): Excise duties are levied on goods produced within the country and are also a recurring source of revenue.

- Non-Tax Revenue (9 paise): This includes interest, dividends, profits, etc., which are recurring in nature.

Reasons for Revenue Receipts:

Revenue receipts are the receipts of the government that do not create any liability for the government and are recurring in nature. They are a regular source of income for the government.

Capital Receipts:

- Borrowings and Other Liabilities (20 paise): Borrowings create a liability for the government to repay the principal amount along with interest.

- Recovery of Loan (3 paise): Recovery of loans decreases the assets of the government.

Reasons for Capital Receipts:

Capital receipts are the receipts of the government that create a liability for the government or reduce its assets. They are generally non-recurring in nature.

(ii) Distinguish between Revenue Deficit and Fiscal Deficit.

Answer:

Revenue Deficit:

- Definition: The revenue deficit is the difference between the government’s revenue expenditure and its revenue receipts.

- Formula: Revenue Deficit = Revenue Expenditure – Revenue Receipts

- Implication: A high revenue deficit indicates that the government is spending more on its day-to-day operations than it is earning from its regular sources of revenue. This implies a need for borrowings to finance the revenue expenditure, which can lead to increased debt burden.

Fiscal Deficit:

- Definition: The fiscal deficit is the difference between the government’s total expenditure (revenue and capital) and its total receipts excluding borrowings.

- Formula: Fiscal Deficit = Total Expenditure – (Revenue Receipts + Non-debt Capital Receipts) OR Fiscal Deficit = Borrowings + Other Liabilities

- Implication: The fiscal deficit indicates the total borrowing requirements of the government to meet its expenditure, including developmental and capital expenditures. A high fiscal deficit can lead to inflation, increased debt burden, and crowding out of private investment.

Question 18(b)(i):

From the following data, calculate the primary deficit:

| Particulars | Amount (in crore) |

|---|---|

| (i) Revenue deficit | 40 |

| (ii) Non-debt creating capital receipts | 190 |

| (iii) Tax revenue | 125 |

| (iv) Capital expenditure | 220 |

| (v) Interest payments | 20 |

Answer:

The primary deficit is calculated as the Revenue Deficit minus the Interest Payments.

Given:

- Revenue Deficit = ₹40 crore

- Interest Payments = ₹20 crore

So, the primary deficit is ₹20 crore.

Question 18(b)(ii):

Elaborate the ‘Economic Stability’ function of the Government Budget.

Answer:

The economic stability function of the government budget involves managing the economy’s growth and minimizing fluctuations that could lead to recession or inflation. It helps in stabilizing the overall economic environment by using fiscal tools like government spending, taxation, and borrowing. Key points are:

-

Control Inflation: The government uses the budget to manage inflation by controlling aggregate demand. For example, during inflationary periods, the government may reduce spending or increase taxes to reduce excess demand in the economy.

-

Stimulate Growth: During economic slowdowns or recessions, the government can use the budget to stimulate economic activity through increased public spending and tax cuts to boost aggregate demand and employment.

-

Maintain Balance in External Sector: The budget helps the government manage its foreign exchange reserves and trade balance. By controlling imports through tariffs or subsidies on exports, it works toward maintaining a stable external sector.

-

Prevent Excessive Debt: The government budget also includes strategies to manage public debt, ensuring that borrowing doesn’t get out of hand, which could destabilize the economy. It ensures long-term fiscal sustainability.

In essence, the economic stability function aims at ensuring steady economic growth without excessive inflation or deflation, and maintaining overall financial balance within the economy.

Indian Economic Development:

Question:

Read the following statements carefully:

Statement 1: Commercialization of agriculture under the British rule was responsible for frequent famines between 1875 and 1900.

Statement 2: During British rule, India began to export food grains.

In light of the given statements, choose the correct alternative from the following:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 1 is false and Statement 2 is true.

(c) Both Statements 1 and 2 are true.

(d) Both Statements 1 and 2 are false.

Answer:

(c) Both Statements 1 and 2 are true.

Explanation:

-

Statement 1 is true because during the British colonial period, the commercialization of agriculture led to the focus on cash crops like cotton, indigo, and opium for export, rather than food crops. This disrupted local food production, contributing to frequent famines between 1875 and 1900.

-

Statement 2 is also true because under British rule, India began to export food grains, especially during the period when it was integrated into the global market, but this often came at the cost of local food security.

Both statements are correct because commercialization of agriculture and food grain exports contributed to both famines and changes in agricultural practices during British rule.

Question 19(A):

Read the following statements carefully:

Statement 1: The purchase of food grains made by the Government on the Minimum Support Price (MSP) is maintained as buffer stock.

Statement 2: Minimum Support Price safeguards the farmers against any sharp fall in farm product prices.

In light of the given statements, choose the correct alternative from the following:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 1 is false and Statement 2 is true.

(c) Both Statements 1 and 2 are true.

(d) Both Statements 1 and 2 are false.

Answer:

(c) Both Statements 1 and 2 are true.

Explanation:

-

Statement 1 is true because the government purchases food grains at the Minimum Support Price (MSP) and stores them as buffer stock. This is done to ensure food security and to stabilize the prices of essential commodities.

-

Statement 2 is also true because the MSP acts as a safety net for farmers. It guarantees them a minimum price for their crops, protecting them from a sharp fall in market prices. This helps ensure that farmers have a steady income despite fluctuations in market prices.

Question 19(B):

Identify the incorrect statement from the following:

(a) Import substitution was the strategy used to save foreign exchange.

(b) License policy ensured regional equality.

(c) Russian economic model was the base for the Indian economic system.

(d) Small Scale Industries are one of the essential tools for employment generation.

Answer:

(b) License policy ensured regional equality.

Explanation:

-

Statement (a) is correct because import substitution was indeed used as a strategy in India to reduce dependence on foreign imports and save foreign exchange. This was a major part of India’s economic policy after independence.

-

Statement (c) is also correct because India adopted a mixed economy model, which was influenced by the Russian economic system (a socialist model with public sector dominance) after independence.

-

Statement (d) is correct because small-scale industries have been an essential part of India’s employment generation strategy, especially in rural areas and for promoting entrepreneurship.

-

Statement (b) is incorrect. The License Raj system (which required businesses to obtain licenses for various activities) did not ensure regional equality. It led to inefficiencies and the concentration of industry in certain regions (mostly urban centers) rather than promoting balanced regional development.

Question 20:

Mini-hydel plants are good for the environment because:

(i) they generate electricity only for local areas.

(ii) they do not change the land use pattern.

(iii) they rely on the perennial streams.

Choose the correct alternative:

(a) (i), (ii), and (iii)

(b) (ii) and (iii)

(c) (i) only

(d) (i) and (ii)

Answer:

(a) (i), (ii), and (iii)

Explanation:

-

(i) is true because mini-hydel plants typically generate electricity for local areas and help reduce transmission losses, making them suitable for small-scale, decentralized power generation.

-

(ii) is true because mini-hydel plants have a smaller environmental footprint compared to large hydroelectric plants and generally do not require significant changes to the land use pattern. They typically do not involve large dams or reservoirs.

-

(iii) is true because mini-hydel plants are often designed to rely on perennial streams or rivers with consistent flow, which ensures reliable electricity generation.

Thus, all the statements (i), (ii), and (iii) are correct, and (a) is the right choice.

Question 21 (A):

The Great Leap Forward (GLF) campaign in China focused on (Choose the correct alternative to fill up the blank)

(a) Widespread industrialisation

(b) New agricultural strategy

(c) Privatisation

(d) Economic reforms

Answer:

(b) New agricultural strategy

Explanation:

The Great Leap Forward (1958–1962) in China was an initiative led by Mao Zedong that focused on rapid industrialisation and the transformation of agriculture. The main aim was to collectivize farms and establish large communes, in order to increase agricultural and industrial production. This campaign focused heavily on new agricultural strategies, particularly by forming collective farming systems to increase productivity, but ultimately led to failure and famine.

Question 21 (B):

India is not a member of which of the following regional/global economic groups?

(a) European Union

(b) BRICS

(c) G20

(d) SAARC

Answer:

(a) European Union

Explanation:

India is not a member of the European Union (EU), which is a political and economic union of European countries. However, India is a member of BRICS (Brazil, Russia, India, China, and South Africa), G20 (Group of Twenty), and SAARC (South Asian Association for Regional Cooperation).

Question 22:

‘Skill India’ programme launched by the Government is not an attempt to increase (Choose the correct alternative to fill up the blank)

(a) Human capital formation

(b) Efficient utilisation of inputs

(c) Increase in GDP growth

(d) Inadequate spread of vocational education

Answer:

(d) Inadequate spread of vocational education

Explanation:

The Skill India programme launched by the Government of India is focused on providing skills training and promoting human capital formation by improving vocational education. It aims to enhance the employability of the youth, develop skilled manpower, and contribute to economic growth. It is not specifically about inadequate spread of vocational education but rather about addressing skill gaps and creating opportunities for vocational education and training.

Question 23:

Identify the correct alternative with reference to the following statement:

“Between 1966-76, Mao introduced this movement under which professionals and students were asked to work and learn from real-life situations prevailing in the countryside of China.”

(a) Commune System

(b) Great Leap Forward

(c) Open Door Policy

(d) Great Proletarian Cultural Revolution

Answer:

(d) Great Proletarian Cultural Revolution

Explanation:

Between 1966-1976, Mao Zedong initiated the Great Proletarian Cultural Revolution in China. During this period, students and professionals were encouraged to go to the countryside to learn from the rural peasants and immerse themselves in real-life situations, all in an effort to promote the ideology of communist purity and eliminate capitalist and traditional elements from Chinese society.

- Option (a) refers to the Commune System, which was part of the Great Leap Forward.

- Option (b) refers to the Great Leap Forward, which was focused on industrialisation and agricultural collectivisation.

- Option (c) refers to the Open Door Policy, which is related to the United States’ trade policy with China, not a social movement.

Therefore, the correct answer is (d) Great Proletarian Cultural Revolution.

Question 24:

Read the following statements carefully:

Statement 1: In both India and Pakistan, the service sector has been emerging as a major source of development.

Statement 2: Amongst the neighbours of India, China has the highest life expectancy rate.

In light of the given statements, choose the correct alternative from the following:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 1 is false and Statement 2 is true.

(c) Both Statements 1 and 2 are true.

(d) Both Statements 1 and 2 are false.

Answer:

(c) Both Statements 1 and 2 are true.

Explanation:

-

Statement 1 is true. Both India and Pakistan have seen significant growth in the service sector, contributing to their economic development. In India, the IT and services sectors have been key drivers of growth.

-

Statement 2 is also true. Among India’s neighbors, China has the highest life expectancy rate due to improvements in healthcare, nutrition, and overall living conditions compared to countries like India and Pakistan.

Question 25 (A):

Workers who are on the permanent pay-roll of their employer are called ___________ workers.

(Choose the correct alternative to fill up the blank)

(a) self-employed

(b) casual

(c) regular

(d) hired

Answer:

(c) regular

Explanation:

Regular workers are those who are employed on a permanent basis and receive regular pay from their employer. They have a stable job with benefits, unlike casual or temporary workers.

Question 25 (B):

Jobless growth leads to unemployment because __________ .

(Choose the correct alternative to fill up the blank)

(a) Labour refuses to migrate

(b) Labour is very expensive

(c) Growth rate is low

(d) Growth is due to technological development

Answer:

(d) Growth is due to technological development

Explanation:

Jobless growth refers to a situation where economic growth does not lead to significant job creation. This often happens when growth is driven by technological advancements that increase productivity but reduce the need for human labor. As a result, employment opportunities may not increase, leading to higher unemployment rates.

Question 26:

Production of diverse varieties of crops rather than one specialized crop is called __________.

(Choose the correct alternative to fill up the blank)

(a) diversification of crops

(b) diversification of agricultural production

(c) diversification in sectors

(d) diversification of employment

Answer:

(a) diversification of crops

Explanation:

The process of growing a variety of crops instead of focusing on just one specialized crop is known as diversification of crops. This approach helps mitigate risks associated with the failure of a single crop and improves overall agricultural stability.

Question 27:

Read the following statements carefully:

Statement 1: India announced its First Five Year Plan in 1951.

Statement 2: India, Pakistan, and China adopted economic planning as the core development strategy.

In light of the given statements, choose the correct alternative from the following:

(a) Statement 1 is true and Statement 2 is false.

(b) Statement 1 is false and Statement 2 is true.

(c) Both Statements 1 and 2 are true.

(d) Both Statements 1 and 2 are false.

Answer:

(c) Both Statements 1 and 2 are true.

Explanation:

-

Statement 1 is true. India announced its First Five-Year Plan in 1951, which marked the beginning of economic planning in India.

-

Statement 2 is also true. Both India, Pakistan, and China adopted economic planning as a core development strategy, especially in the mid-20th century, aiming to achieve planned economic growth.

Question 28. Interpret the given picture, on account of current environmental

challenges :

Note : The following question is for the Visually Impaired Candidates

only, in lieu of Q. No. 28 :

Explain any one current environmental challenge

Answer:

-

Loss of Biodiversity: The clearing of forests, as shown in the picture, leads to habitat loss for countless species of plants and animals. This can result in population declines and even extinctions, diminishing the biodiversity of our planet. Forests are intricate ecosystems, and their destruction disrupts the delicate balance of nature.

-

Climate Change: Trees absorb carbon dioxide, a major greenhouse gas, during photosynthesis. When forests are cut down and burned or left to decompose, this stored carbon is released back into the atmosphere as carbon dioxide, contributing significantly to global warming and climate change. Deforestation is a major driver of the increased greenhouse effect.

-

Soil Erosion: Tree roots hold soil together, preventing erosion. When forests are cleared, the soil is exposed to the elements, making it vulnerable to wind and rain. This can lead to soil degradation, loss of nutrients, and downstream sedimentation of rivers and water bodies.

-

Disruption of Water Cycles: Forests play a crucial role in regulating water cycles. Trees release water vapor into the atmosphere through transpiration, contributing to cloud formation and rainfall. Deforestation can disrupt these patterns, leading to decreased rainfall in some areas and increased risk of droughts in others. It can also affect local water tables and the flow of rivers.

-

Impact on Local Communities: For many indigenous and local communities, forests are not just a source of resources but also their home and cultural heritage. Deforestation can displace these communities, disrupt their traditional livelihoods, and have profound social and economic consequences.

-

Economic Losses: While deforestation may provide short-term economic gains, it can lead to long-term economic losses due to the depletion of natural resources, decreased agricultural productivity from soil erosion, and the costs associated with dealing with the impacts of climate change.

Question 29 (a):

Critically evaluate the role of rural banking system in the process of rural development in India.

Answer:

The rural banking system plays a crucial role in the rural development of India by providing financial services to farmers, rural entrepreneurs, and small businesses. Some key contributions include:

-

Providing Credit to Farmers: Rural banks offer short-term and long-term credit to farmers for purchasing seeds, fertilizers, and machinery, which increases agricultural productivity.

-

Financing Rural Infrastructure: These banks help finance projects like irrigation, rural roads, and electrification, which are essential for rural development.

-

Promoting Self-Employment: Banks provide loans to rural entrepreneurs to set up small-scale industries or businesses, creating jobs and reducing poverty.

-

Microfinance and SHGs (Self-Help Groups): Through microfinance schemes and the formation of SHGs, rural banks empower women and small-scale entrepreneurs to access credit, even without traditional collateral.

However, challenges such as limited financial literacy, lack of access to banking infrastructure in remote areas, high default rates, and bureaucratic inefficiencies hinder the effectiveness of rural banking in some regions. Despite these challenges, rural banking is fundamental to financial inclusion and improving rural livelihoods.

Question 29 (b):

“Dr. Khurana, a dentist, ran his clinic in an economically backward area. He was earning a comparatively low income. So, he decided to move to a city and spent a huge amount for the same.” Identify and explain the type of expenditure incurred by Dr. Khurana, which directly contributed to the process of human capital formation.

Answer:

Dr. Khurana’s decision to spend a huge amount to relocate to the city can be considered as an investment in human capital formation. The type of expenditure incurred is related to education, skill enhancement, and improved infrastructure.

The investment in relocating to a more economically active area enables Dr. Khurana to:

-

Expand his Practice: By moving to a city, Dr. Khurana is likely to have access to better infrastructure, a larger clientele, and better earnings potential, which contributes to the development of his professional skill and growth.

-

Human Capital Formation: The expenses incurred in relocating and setting up a clinic involve enhancing his capacity to earn and improving his ability to contribute to the economy.

This type of expenditure promotes human capital formation as it increases the skills, productivity, and earning potential of an individual.

Question 30:

Explain valid reasons for the slow growth and re-emergence of poverty in Pakistan.

Answer:

The slow growth and re-emergence of poverty in Pakistan can be attributed to several factors:

-

Political Instability: Frequent changes in government, political corruption, and weak institutions have hindered long-term economic planning and reforms.

-

Dependence on Foreign Aid: Pakistan’s dependence on foreign aid and loans has created an economic model that focuses on short-term relief rather than long-term sustainable development.

-

Security Issues and Conflicts: Internal security issues, the ongoing conflict with neighboring countries, and terrorism have disrupted economic activity, limiting foreign investment and growth prospects.

-

Lack of Industrial Diversification: Pakistan’s economy has relied heavily on agriculture, which has been vulnerable to climate changes, low productivity, and insufficient investment in infrastructure.

-

Low Education and Health Standards: Poor educational infrastructure and inadequate healthcare systems have contributed to a low-skilled labor force, limiting the potential for economic growth.

-

Inequality and Social Issues: The unequal distribution of wealth and resources, coupled with lack of social welfare policies, has led to a widening gap between the rich and poor, exacerbating poverty.

Question 31 (a):

Explain briefly the rationale behind the ‘License Raj’ under the Industrial Policy Resolution, 1956.

Answer:

The ‘License Raj’ refers to the system of government controls and permits that regulated the establishment, expansion, and operation of industries in India after independence, particularly following the Industrial Policy Resolution of 1956. The rationale behind this system was:

-

Control over Industrial Growth: The government wanted to regulate industrial development to ensure that it was consistent with national goals, such as self-reliance, social welfare, and economic planning.

-

Protection of Domestic Industries: It aimed to protect domestic industries from foreign competition by controlling the entry of foreign companies and limiting the expansion of private industries.

-

Promotion of Public Sector: The policy gave priority to public sector industries, limiting the growth of private enterprises in certain sectors. The state was seen as the driver of industrial growth.

-

Avoidance of Monopolies: By controlling licensing and production, the government aimed to avoid the concentration of wealth and power in the hands of a few industrialists and prevent monopolies.

However, over time, the License Raj led to inefficiencies, corruption, and lack of competition, stifling industrial growth and innovation, which were only addressed after economic liberalization in 1991.

Question 31 (b):

Define Multilateral trade.

Answer:

Multilateral trade refers to trade between more than two countries or parties, usually within a framework of international agreements and organizations. The most well-known example of multilateral trade is the World Trade Organization (WTO), which facilitates trade agreements among multiple countries to promote fair trade practices, reduce tariffs, and establish common trade standards.

In multilateral trade, goods, services, and capital can flow freely between countries, benefiting all parties involved through access to broader markets and resources. Multilateral agreements typically aim to liberalize trade, encourage economic cooperation, and resolve trade disputes among member nations.

Question 32 (a):

State and elaborate whether the following statement is true or false, with valid arguments:

“Indian economy has showed satisfactory progress towards formalization of workforce in the recent past.”

Answer:

False. While there has been some progress in the formalization of the workforce in India, the progress is not entirely satisfactory. The informal sector continues to dominate the Indian economy, contributing significantly to employment, with a large portion of the workforce in the unorganized sector. Some key points to explain this include:

-

Large Informal Workforce: As of recent estimates, a significant percentage (around 80%) of the Indian workforce is still engaged in the informal sector, which is characterized by unregistered businesses, low wages, and lack of social security.

-

Limited Access to Formal Benefits: Workers in the informal sector do not have access to benefits such as pensions, insurance, or healthcare, which are typically available in the formal sector. This limits the effectiveness of India’s efforts to promote inclusive development.

-

Government Initiatives: The government has implemented initiatives like GST and e-shram portals aimed at formalizing the economy, but challenges such as low awareness, lack of infrastructure, and technological barriers still hinder substantial progress.

-

Slow Adoption of Technology: While digital technologies and platforms like UPI are being introduced, they have yet to fully transform informal sector practices.

Question 32 (b):

“In India, the self-employed constitute around 60% of employees. The possible incidence of underemployment is the highest among the self-employed.”

Answer:

True. In India, a significant portion of the workforce is self-employed, particularly in rural areas and informal sectors. While self-employment may seem attractive, it often results in underemployment due to the following reasons:

-

Lack of Regular Income: Many self-employed individuals work in low-income sectors (like small shops, agriculture, or unorganized services) with inconsistent earnings, leading to underemployment.

-

Limited Access to Capital and Technology: Self-employed workers often lack access to modern tools, capital, and technologies that can increase productivity. This restricts their ability to expand their business and increases the risk of underemployment.

Two Measures to Ensure More Productive Employment for the Self-Employed:

-

Skill Development Programs:

Government schemes like Pradhan Mantri Kaushal Vikas Yojana (PMKVY) can be expanded to equip self-employed workers with market-relevant skills, improving productivity and enabling them to access better job opportunities. -

Access to Microcredit and Digital Platforms:

Facilitating easier access to microcredit (through institutions like MUDRA Bank) can help self-employed individuals invest in technology and improve their business processes. Additionally, integrating self-employed workers into digital platforms for online sales, payments, and marketing can increase their market reach and productivity.

Question 33 (a)(i):

Why are fewer women found in regular salaried employment?

Answer:

There are several factors that contribute to the lower participation of women in regular salaried employment in India:

-

Cultural and Societal Norms: In many parts of India, societal expectations dictate that women prioritize family responsibilities (such as child-rearing and household chores) over career ambitions, limiting their participation in the formal labor market.

-

Gender Discrimination: Women face discrimination in terms of wages, promotions, and job opportunities. Even in sectors where women do participate, they are often confined to lower-paying or lower-status roles.

-

Safety Concerns: Women’s mobility is restricted due to concerns about safety, especially in public transport or in rural areas. This impacts their ability to take up regular salaried jobs.

-

Lack of Work-Life Balance: The lack of workplace flexibility, such as limited parental leave and insufficient childcare facilities, can discourage women from taking up regular salaried employment.

Question 33 (a)(ii):

Distinguish between human capital and physical capital.

Answer:

-

Human Capital:

- Definition: Human capital refers to the skills, knowledge, experience, and abilities of individuals that contribute to their productivity and economic value.

- Characteristics: It is intangible and can be improved through education, training, and experience.

- Example: A skilled workforce, trained professionals, and educated individuals.

-

Physical Capital:

- Definition: Physical capital refers to the tangible assets or tools that are used to produce goods and services.

- Characteristics: It is tangible, can be measured, and includes machinery, buildings, equipment, and infrastructure.

- Example: Factories, computers, transportation vehicles, and machinery.

Question 33 (b):

State and discuss any one strategy involved in attaining sustainable development in India.

Answer:

One important strategy for attaining sustainable development in India is:

Promoting Renewable Energy:

India is focusing on expanding its renewable energy sector to reduce dependence on fossil fuels, improve energy efficiency, and combat climate change. The government has set ambitious targets for increasing solar power capacity and wind energy generation.

Key Points:

- Solar Energy: India aims to achieve 175 GW of renewable energy capacity by 2022, with a significant contribution from solar power. This helps reduce carbon emissions and ensure energy security.

- Wind and Hydro Power: The development of wind and hydropower projects further contributes to reducing reliance on coal and other non-renewable energy sources.

The strategy focuses on eco-friendly energy production, reduces carbon footprints, and creates jobs in the green energy sector, thus contributing to sustainable economic growth.

Question 33 (c):

Discuss briefly the importance of microcredit programmes in rural India.

Answer:

Microcredit programs play a significant role in the rural development of India by offering small loans to individuals who have limited access to formal financial services. Some key points highlighting the importance of microcredit in rural India are:

-

Empowerment of Women: Microcredit programs, such as those run by Self-Help Groups (SHGs), often target women in rural areas, empowering them economically and socially. These women gain financial independence and contribute to household incomes.

-

Promotion of Entrepreneurship: Microcredit helps rural entrepreneurs, particularly in agriculture and small businesses, access funds to improve productivity, invest in tools or equipment, and expand their operations.

-

Reduction of Poverty: By enabling small-scale businesses to flourish, microcredit helps alleviate poverty in rural areas by providing the means for sustainable livelihoods.

-

Access to Financial Services: Microcredit promotes financial inclusion by providing loans to individuals who may not qualify for traditional banking services, fostering greater economic participation.

Question 34 (a):

Which institution has been replaced by NITI Aayog in India? Who is the ex-officio Chairman of NITI Aayog?

Answer:

The Planning Commission of India was replaced by the NITI Aayog (National Institution for Transforming India) in 2015. The ex-officio Chairman of NITI Aayog is the Prime Minister of India.

Question 34 (b):

State and discuss any two main advantages of digital banking.

Answer:

Advantages of Digital Banking:

-

Convenience and Accessibility:

Digital banking provides round-the-clock access to banking services, allowing users to conduct transactions, pay bills, transfer funds, and access accounts without the need to visit a physical bank branch. This is particularly beneficial for people in remote or rural areas. -

Enhanced Security and Reduced Risk of Counterfeit Currency:

Digital banking reduces the reliance on physical cash, minimizing the risks associated with counterfeit currency. Additionally, digital transactions are often encrypted and secure, providing a safer alternative to traditional banking methods.